4 Proven Factors that Drive Success and Help You Invest with Power!

Earnings Quality, Direct Ownership, Cost-Efficiency, Control

Building on 35 Years of Experience

Using the experience gained from 35 years managing the portfolios of wealthy investors, Linden Thomas & Company found that there are distinct disadvantages with the index funds so many investors make use of today. The disadvantages can often lead to lower returns. One of the most significant issues with ETFs like the S&P 500 is that they contain companies that are unhealthy, and hold them as they continue to go down, sometimes until they become delisted.

The team at Linden Thomas & Company set out to solve this by building more efficient indexes that focus first on earnings quality. By only including stocks with high earnings quality in their balanced portfolios, the team found that a smart index investor would significantly outperform an index like the S&P 500.

Further research by the team revealed that directly owning the companies in an index was preferable to being pooled with many investors, which is typical of how ETFs and mutual funds accumulate shares today. Directly owning a portfolio of stocks allows an investor to avoid the effects of a selloff in an ETF, which may drive the price down further than the underlying assets would suggest. It also allows an investor to track the individual holdings in their portfolio easily, while tracking the amount of each stock an investor holds in a typical ETF is often difficult.

Costs are often much higher in retail equity mutual funds and ETFs than their advertised management fee. There are trading costs that are controlled by the index company, which over time considerably reduce the total return of a portfolio.

Linden Thomas & Company wants to share these discoveries and solutions to the wider world and started the Indexperts site to provide a platform for investors to build portfolios that avoid the pitfalls of investing in flawed ETFs. With a platform accessible to all clients, and research available to all clients, Indexperts hopes to democratize the index investing landscape, so that all investors whether big or small can benefit and profit.

PROVEN RESULTS

4 factors that we found enhanced returns to investors:

1. EARNINGS QUALITY

2. DIRECT OWNERSHIP OF EQUITIES

3. MANAGING COST

4. CONTROL & TRANSPARENCY

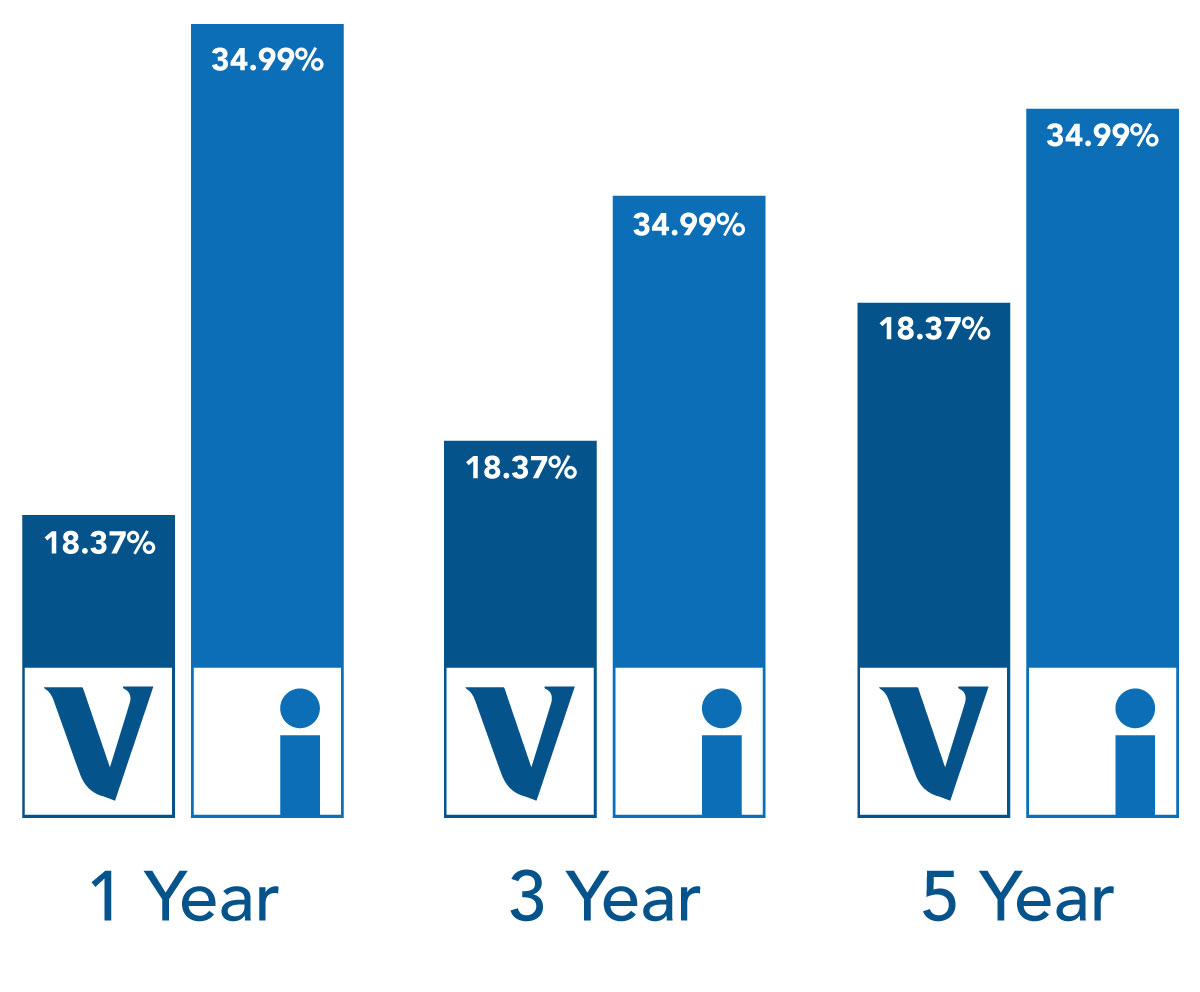

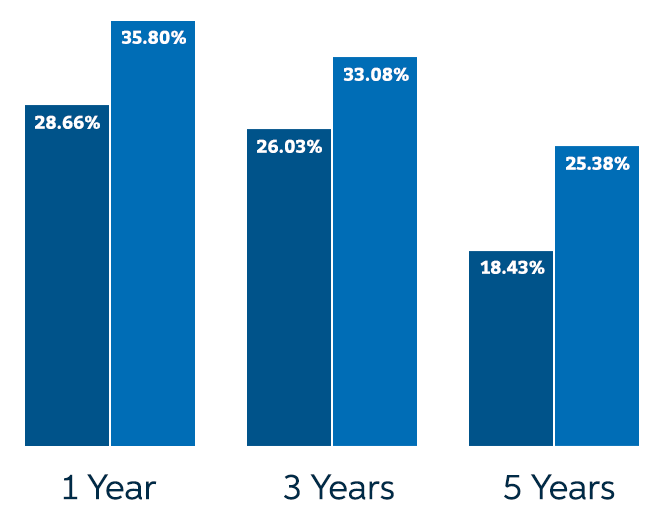

The Indexperts four factors of earnings quality, direct fractional ownership, cost, and control, have proven to deliver enhanced results. Compared to traditional market-cap index funds, our four factor approach has delivered market-beating returns the last 1, 3, & 5 Years.

4 factors

that drive smart investor results!

the proof is in the performance!

*The above chart is backtested over time & for illustration purposes only. Click here for full disclaimer information.Today!