Quality Focused Indexing Accessible to All

Our View on Growth

Owning growth stocks can be a great way to benefit from companies innovating for the future, but their strong upside potential comes with risks as well. That's why it's important to buy high-quality and spread risk. When balanced properly, growth stocks can be an important piece of the portfolio puzzle.

Our View on Value

Owning value stocks can underpin a well-balanced portfolio by offering exposure to companies with mature business models and a track record of success.

Our View on Bonds

Bonds provide the basis for a strong portfolio foundation. By providing predictable cash flow to the investor, investors can use bonds to tailor the portfolio to their specific risk and income needs.

How to Buy Indexperts ETFs

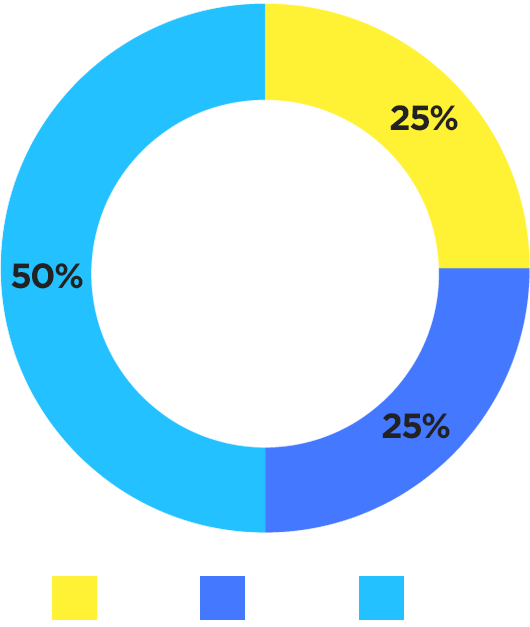

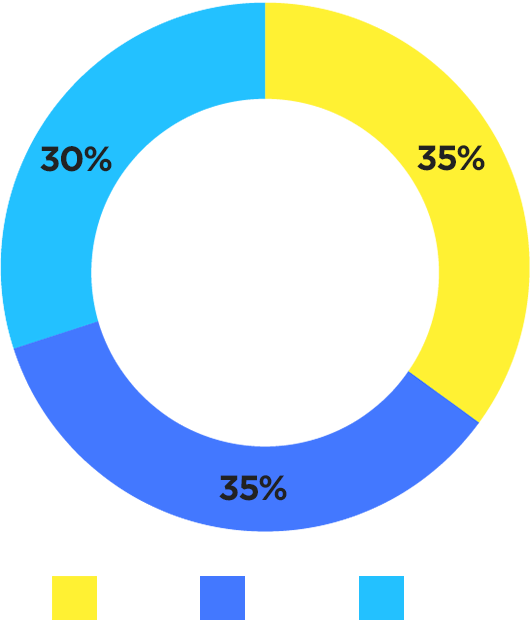

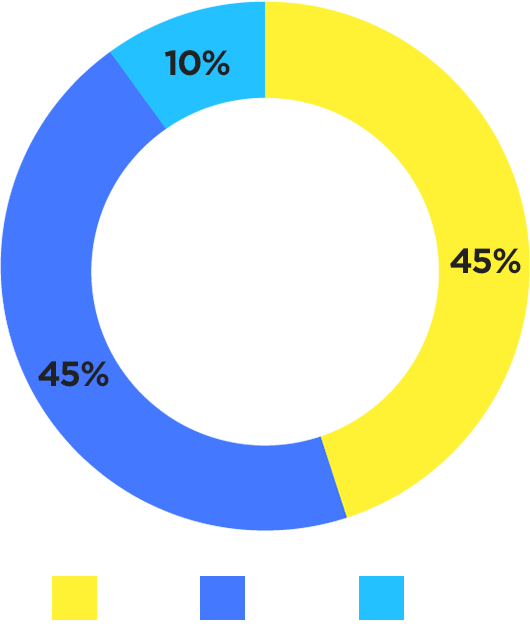

Balance can Spread Risk and Enhance Results

Build a portfolio that is balanced across earnings-focused growth, value, and yield-focused fixed income.

An investor should consider the Funds investment objectives, risks, charges and expenses before investing. The prospectus contains this and other important information about the Fund. A copy of the prospectus is available at https://etfpages.com/?t=RILA, https://etfpages.com/?t=QIDX, https://etfpages.com/?t=YFFI or by calling Shareholder Services at 1-800-773-3863. The prospectus should be read carefully before investing. Current and future holdings are subject to change and risk.

An investment in the Funds is subject to investment risk, including the possible loss of some or the entire principal amount invested. There can be no assurance that the Funds will be successful in meeting their investment objective.

Investment in RILA & QIDX are also subject to the following risks:

Common Stock/Equity Security Risk

Common stocks hold the lowest priority in a company's capital structure, and therefore, takes the largest share of the company's risk and company's risk and its accompanying volatility.

Growth Stock Risk

Growth stocks can react differently to issuer, political, market, and economic developments that the market as a whole and other types of stocks. The stocks of such companies can therefore be subject to more abrupt or erratic market movements than stocks of larger more established companies or the stock market in general.

Investment in YFFI is also subject to the following risks:

Interest Rate Risk

As interest rates rise the value of fixed income securities is likely to decrease. As interest rates fall, the value of fixed income securities are likely to increase. Changes in interest rates may affect the Fund's share price, for example, a sharp rise in interest rates could cause the Fund's share price to fall.

Fixed Income Risk

The Fund's investments in fixed income securities will be subject to various risks including interest rate risk, credit risk, extension risk, and prepayment risk. These risks could affect the value of a particular investment by the Fund, possibly causing the Fund's share price and total return to be reduced and fluctuate more than other types of investments.

Investments in RILA, QDIX and YFFI are also subject to the following risk:

New Fund Risk

The Fund is newly formed and has little operating history. Accordingly, investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategy, may not employ a successful investment strategy, or may fail to attract sufficient assets under management to realize economics of scale, any of which could result in the Fund being liquidated at any time without shareholder approval and at a time that may not be favorable for all shareholders.

While Fund shares are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress. ETFs trade like stocks, are subject to investment risks, fluctuate in market value, and may trade at prices above or below the ETF's net asset value. Brokerage commissions and ETF expenses will reduce return. More information about these and other risks can be found in the Fund's prospectus.

Indexperts Gorilla Aggressive Growth ETF (RILA); Indexperts Quality Earnings Focused ETF (QIDX); and Indexperts Yield Focused Fixed Income ETF (YFFI) are distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 209, Raleigh, North Carolina 27609. There is no affiliation between Indexperts, LLC and their principals, and Capital Investment Group, Inc.

RCIND1025004